Effortless Payment Solutions for Your Business

Welcome to the future of card payment terminals!

High-risk merchant accounts

Provide secure and convenient 2D verification, 3D verification payment solutions and bank card processing services for high-risk industries.

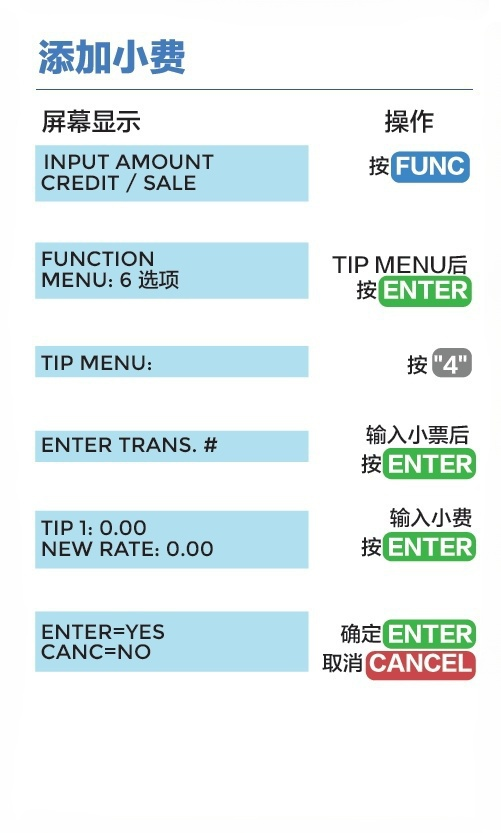

PAYMENT TERMINAL USAGE INSTRUCTIONS

Trusted by 500+ Companies

-

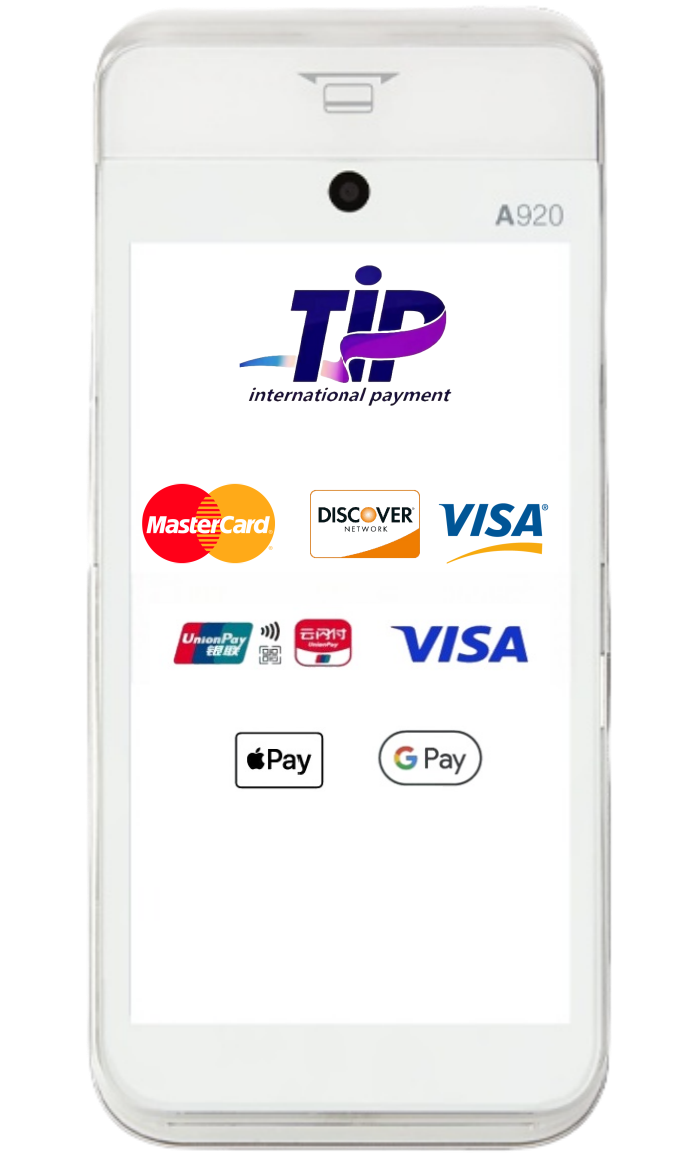

The A920 can be connected by GPRS to a roaming SIM card so you can take payment on the move at any time for any occasion, so whether you are taking payment inn the middle of a field for door entry or connected to high speed through the Wifi option the Pax A920 is a perfect device for any business that is on the lookout for a feature rich, super fast processing payment terminal for their business.

-

The Pax A920 is multi functional and can be operated as a mini epos system as well as a payments device. The processor within the A920 is fast enough to process a payment in a matter of 2/3 seconds. The A920 Pro version has a larger processor and a-slightly larger screen making it the perfect fit for a mini POS solution.

-

The great thing about the Pax A920 device is the innovation on the Pax Store, think of it like the apple store for payment devices, this store has an abundance of quality value added apps that can be pushed to your payment terminal remotely, Loyalty apps, Mini Epos software amongst many others that turn your Pax A920 into a mean machine of a payment terminal.

Reliable And Efficient Payment Features

No network? Don’t worry, we support offline card swiping mode.

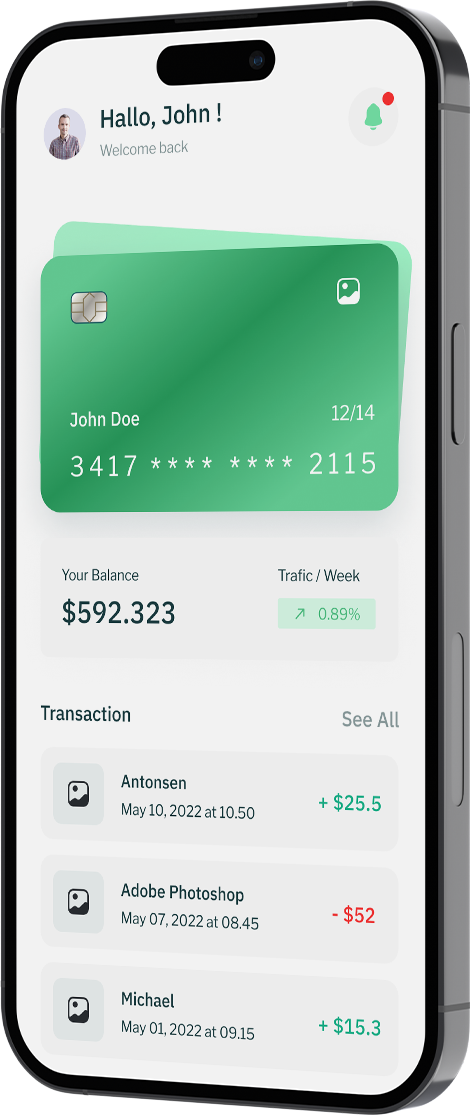

Personal Dashboard

Merchant independent payment backend

Payment Management

Manage payments with professional tools

Integrated Payments

Integrate multiple payment methods, including VISA, MasterCard, UnionPay and other international payment brands.

Business Tracking

Order query is simple, and one-click query function can be enabled.

Credit & Debit Card

Credit cards, debit cards, gift cards all done with one terminal.

Settlement cycle

The settlement cycle is short, no long waiting, no deposit required. Some special merchants can settle in real time on T+0.

Multiple Payment

There is no need to report multiple payments, saving time and working with peace of mind.

International Payment

International payments are as easy to make as local payments.

Years of experience

Global downloads

Positive Review

Return on investment

MOBILE PAYMENT TERMINALS

Support Payment From Every Platform

Meet all your payment needs and make secure online payments without compromising privacy

Fully regulated UK bank

By the Financial Conduct Authority and the Prudential Regulation Authority, just like other banks.

24/7 customer support

In-app chat managed by friendly, real people with the option to call or email us if you need to.

Apply in minutes

92% of business accounts are opened the same day.

TYPES OF HIGH-RISK BANK ACCOUNTS FOR CBD BUSINESSES

CHALLENGES FOR CBD BUSINESSES WITH HIGH-RISK BANK ACCOUNTS

BEST PRACTICES FOR MANAGING FINANCES WITH A HIGH-RISK BANK ACCOUNT

Despite these challenges, there are some options available for CBD businesses looking to open a high-risk bank account. Some of the most common types of accounts include:

CBD businesses with high-risk bank accounts may face a range of challenges, including:

Despite these challenges, there are some best practices that CBD businesses can follow to manage their finances with a high-risk bank account, including:

Frequently Asked Question

If you have any questions about applying for payment channels, please feel free to contact our customer service manager.

No problem, of course. Our customer service manager will work out a payment plan that suits you through simple communication.

Yes, you only need to provide some simple documents and our account manager will help you complete the application process.

The world is now fighting against money laundering, and all countries’ payments are settled on T+1. However, we can settle T+0 for some good companies. Please consult your account manager for details.

We stipulate that the online payment gateway application must be completed within 10 working days, and the card machine application must be completed within 15 working days. If you need to file a complaint, please contact: complaint@tipspay.co.uk, and we will respond to you within one working day.